The amount works out to INR 74,500 plus Health and Education cess of INR 2,980 (74,500*4%) Based on his age and taxable income, he needs to pay INR 12,500 + 20% of (8,10,000 – 5,00,000) as income tax. After making the eligible deductions, his taxable income works out to INR 8,10,000. Since he falls under the old tax regime, he first needs to calculate his taxable income. He invests in the PPF and purchased life insurance for himself with a premium of INR 2,55,000. Let’s assume a 50-year-old man earns INR 9,60,000 per year.

Once you understand your tax slab based on your income, age and eligible tax deductions, you can use the figures given above to calculate your tax. Health and education cess at 4% is to be applied on amount of surcharge also. *In case where total income includes any income by way of dividend and capital gains chargeable under section 111A and section 112A of Income Tax Act, the rate of surcharge on the amount of income tax computed in respect of that part of income is restricted to 15%. but not exceeding INR 2 Cr.Įxceeding INR 2 Cr. Surcharge is levied over and above the tax subject to marginal relief at following rates if total income exceeds specified limits:Įxceeding INR 50 lakhs but not exceeding INR 1 Cr.Įxceeding INR 1 Cr.

Surcharge (applicable for Old & New Tax Regime): Income Tax Slab for New Regime (FY 2022 – 2023)īetween INR 2,50,001 and INR 5,00,000 per yearĥ% on the amount above INR 2,50,000 (with a total rebate under Section 87A) + 4% cess on income taxīetween INR 5,00,001 and INR 7,50,000 per year INR 1,10,000 + 30% on the income over INR 10,00,000 + 4% cess on income taxįor Individuals Above the age of 80 years (Super Senior Citizens)Ģ0% on the amount above INR 5,00,000 + 4% cess on income tax INR 10,000 + 20% on the income over INR 5,00,000 + 4% cess on income tax

#Income tax calculator full#

INR 1,12,500 + 30% on the income over INR 10,00,000 + 4% cess on income taxįor Individuals Between the age of 60 and 80 years (Senior Citizens)ĥ% on the amount above INR 3,00,000 (With a full rebate under Section 87A)+ 4% cess on income tax INR 12,500 + 20% on the income over INR 5,00,000 + 4% cess on income tax

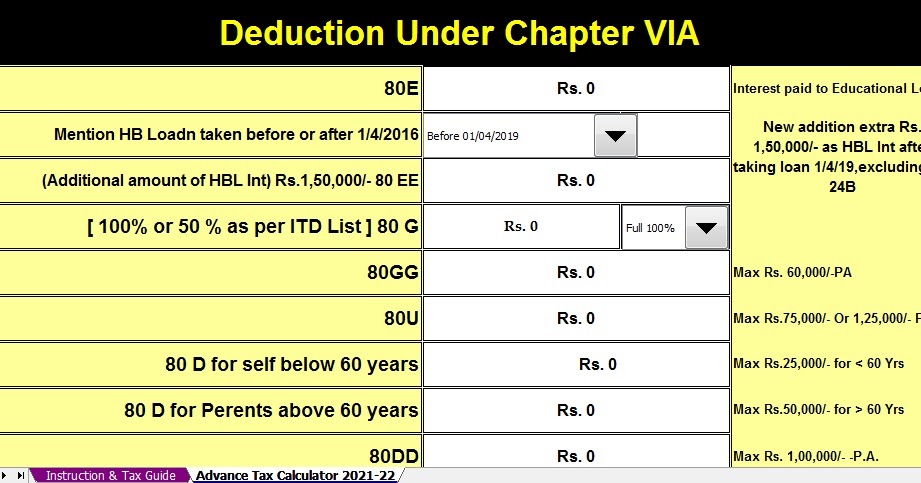

Income Tax Slab for Old Regime (FY 2022 – 2023)įor Individuals Below the age of 60 yearsĥ% on the amount above INR 2,50,000 (with a full rebate under Section 87A) + 4% cess on income tax Currently, there are two tax regimes available in India, each with different taxations for each slab. By dividing individuals under income tax slabs, the Government ensures that people do not pay very heavy taxes. People have to pay taxes based on their annual taxable income. To understand your potential tax liability, you first need to figure out your tax slab. Once that is done, you shall be able to calculate your income tax as per the latest tax regimes and calculations.Then the Calculator will ask you to add the details of any other deductions that you may have.After that, you need to add the details of your 80D deductions.Moving on, you need to add the details of your 80C deductions.Once that is done, you need to add your income from house property.Enter the details as per applicable to you.Further ahead, there will be sections that would require information about your income details such as:.You firstly would need to enter your birth details.

0 kommentar(er)

0 kommentar(er)